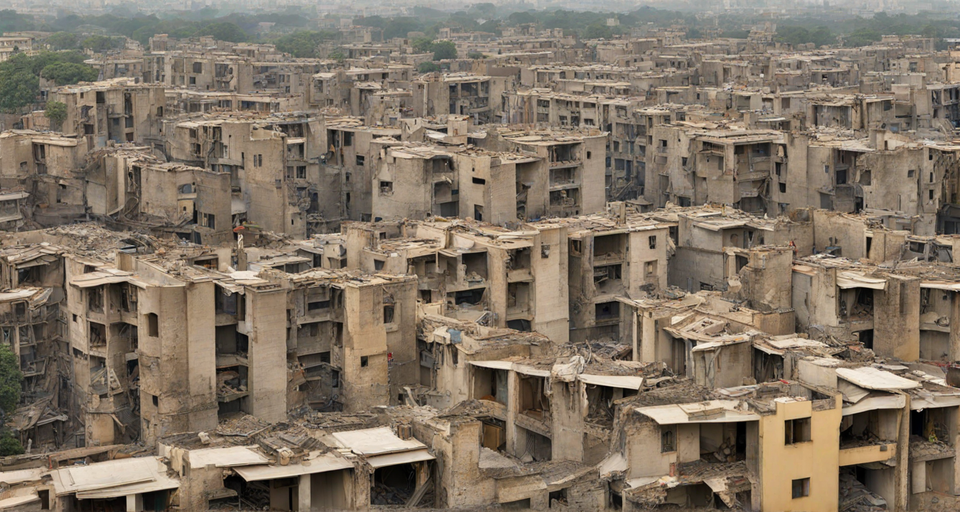

The Delhi-NCR property market holds the largest number of stalled housing units, totaling 1.9 lakh, with an estimated value of nearly Rs 1.2 lakh crore. These housing units, delayed by a minimum of seven years, were launched in 2013 and prior, as reported by property consultant Anarock. By the close of 2020, Mumbai Metropolitan Region (MMR) ranked second with 1,80,250 stalled housing units, amounting to Rs 2,02,145 crore in value.

Across seven major cities in India, a total of 5,02,340 housing units, valued at Rs 4,07,005 crore, remained stalled at the conclusion of the previous year. In 2019, a sum of 1,322 projects encompassing 5.76 lakh units faced delays at various stages.

Anarock Chairman Anuj Puri commented on the report, stating, “Project delays have been the bane of the Indian real estate sector over the last decade. Even the implementation of RERA had only a little impact on this.” He highlighted that, among other challenges, the liquidity crunch posed significant obstacles for developers. To address this, the government introduced the Alternate Investment Fund (AIF) in late 2019, with a corpus of Rs 25,000 crore. Puri noted that this last-mile capitalization mechanism, embedded in the Special Window for Affordable & Mid-Income Housing (SWAMIH) fund, has proven effective in reviving stalled projects.

According to Anarock, 190 stalled or delayed housing projects, comprising over 73,560 units, were successfully completed in 2020. Additional data revealed that Bengaluru had 29,850 delayed housing units, valued at Rs 22,276 crore. Pune experienced delays in 80,480 units worth Rs 49,667 crore by the end of 2020. Kolkata faced delays in 9,180 housing units, amounting to Rs 5,436 crore. Hyderabad and Chennai reported 6,520 units (Rs 4,305 crore) and 5,940 units (Rs 3,886 crore) respectively, that were stuck as of the end of 2020.